Case for a Modestly Higher Progressive Taxation

~50% Rate on Top 0.1% of All Incomes

~1 & 2% Annual Tax on Top 0.1 & .01% Wealth

I am a retired, Indian American psychiatrist, arrived in America in 1971. I have some fourteen, mostly single-author publications in the behavioral science and one on nutrition inThe New Eng. J. Medicine, as well as several presentations at various medical conferences. I have also published a couple of articles in the Indian lay press on how to revise the Indian Constitution from a dangerously unstable Parliamentary system to a more stable Presidential system like in the U.S. – Prime Minister’s power is too elastic based on their parliamentary majority as well as the strength of their personality, from that of a mere puppet if their parliamentary majority is precarious, to that of a dictator if their parliamentary majority is absolute. Both Jawaharlal Nehru and Indira Gandhi had and used dictatorial powers, so has Narendra Modi, but in between, there were Prime Ministers who hardly ruled.

There may be some lacunae in this essay. Despite that, I believe around 65% of the readers who take the time to read this would agree with my arguments, some of which, if I may say so are unique, the reason for me to present them now. I would greatly appreciate if the readers would point out, with or without their suggestions, the “errors” and/or disagreements they encounter with this.

I would like to say most of us do not have a clear grasp of how unfairly the current, “Reagan era” taxation is tilted against low-income groups when the total (both direct and indirect) taxes are scrutinized.

A glaring myth is that the rich pay most of the taxes and that the bottom half pays close to nothing, but too many of them undeservedly benefit from too many taxpayer-supported giveaways and subsidies. Many [conservative] pundits who regularly appear on like-minded TV shows tend to promote such views.)

U.S. Federal income tax rates, History(Some rates are deleted for brevity)

| Year | Number of Brackets | First Bracket Rate | Top Bracket Rate | Top Bracket Income | Adj. 2020 [82][92] | |

| 1913 | 7 | 1% | 7% | $500,000 | $13.1 million | First permanent income tax |

| 1916 | 14 | 2% | 15% | $2,000,000 | $47.6 million | — |

| 1917 | 21 | 2% | 67% | $2,000,000 | $40.4 million | World War I financing |

| 1918 | 56 | 6% | 77% | $1,000,000 | $17.2 million | — |

| 1925 | 23 | 1.125% | 25% | $100,000 | $1.48 million | Post war reductions |

| 1929 | 23 | 0.375% | 24% | $100,000 | $1.51 million | — |

| 1930 | 23 | 1.125% | 25% | $100,000 | $1.55 million | — |

| 1932 | 55 | 4% | 63% | $1,000,000 | $19 million | Depression era |

| 1936 | 31 | 4% | 79% | $5,000,000 | $93.2 million | — |

| 1941 | 32 | 10% | 81% | $5,000,000 | $88 million | World War II |

| 1942 | 24 | 19% | 88% | $200,000 | $3.17 million | Revenue Act of 1942 |

| 1944 | 24 | 23% | 94% | $200,000 | $2.94 million | Individual Income Tax Act of 1944 |

| 1946 | 24 | 19% | 86.45% | $200,000 | $2.65 million | — |

| 1951 | 24 | 20.4% | 91% | $400,000 | $3.99 million | — |

| 1954 | 26 | 20% | 91% | $400,000 | $3.85 million | — |

| 1964 | 26 | 16% | 77% | $400,000 | $3.34 million | Tax reduction during Vietnam war |

| 1965 | 25 | 14% | 70% | $200,000 | $1.64 million | “JFK/LBJ” ‘Tax-cut’ |

| 1971 | 33 | 14% | 70% | $200,000 | $1.28 million | — |

| 1981 | 17 | 13.825% | 69.125% | $215,400 | $613,165 | Reagan era tax cuts started |

| 1982 | 14 | 12% | 50% | $85,600 | $229,556 | —- |

| 1988 | 2 | 15% | 28% | $29,750 | $65,100 | Reagan era tax cuts fully effective |

| 1991 | 3 | 15% | 31% | $82,150 | $156,091 | Omnibus Budget Reconciliation Act of 1990 |

| 1993 | 5 | 15% | 39.6% | $89,150 | $159,714 | Omnibus Budget Reconciliation Act of 1993 |

| 2001 | 5 | 10% | 39.1% | $297,350 | $434,597 | Bush Tax cuts began |

| 2003 | 6 | 10% | 35% | $311,950 | $438,863 | Bush tax cuts |

| 2013 | 7 | 10% | 39.6% | $400,000 | $444,400 | American Taxpayer Relief Act of 2012 |

| 2018 | 7 | 10% | 37% | $500,000 | $510 thousand | Tax Cuts and Jobs Act of 2017 |

Introduction

Regular, federal individual income tax, which was designed as a progressive levy on Americans’ incomes became effective in 1913. The progressive rates have fluctuated greatly reflecting the then need, etc., including the philosophy on social and defense spending by the then administration in power.

A seldom mentioned fact is that our grasp of how taxes, in general, are designed and collected is woefully inadequate. Albert Einstein happened to say, in 1918, “The hardest thing in the world to understand is the income tax.”

Bruce Bartlett, an aficionado on taxation, who wrote several books on the topic and was a senior adviser to Presidents Ronald Reagan and George H.W. Bush writes, Congress had no idea how many tax loopholes there were or how much revenue they were costing the Treasury.”

Furthermore, James Meade, a Nobel laureate in economics (1977) for instance said, paraphrasing, “The frontiers of knowledge when it comes to economics keep expanding at such a rate that it is almost impossible to establish a soundly based understanding of the entire subject and its ever-evolving parts!”

And as an example, the top state income tax rate in Missouri is only 5.4%, on over $8,600, while in California it is a high of 13.3%, on over $1 million,but paradoxically most Californians pay at an appreciably lower rate in state income tax than most Missouriansdo.

Between 1942 and 1981, in the “FDR era” (~ 1933-1980) the top rates of between 70% and 94% were on over (in 2020 dollars) between about $613,000 and $3.17 million. In a capitalist country like the U.S., those rates probably were too high on over such low amounts. Before 1942, however, similar top rates were on over about $17-to-$93 million in 2020 dollars, which were more reasonable, I think – it is worth noting that in the 1936 tax reform, there were 31 different rates from 4% to 79%, the top rate of 79% was on over $5 million ($93.2 million in 2020 dollars, which dropped down to 28% on over $65,100 in 1988!), but was meant to be collected from just one taxpayer, John D Rockefeller – this tells so much in that if the “top 400” income households were to have a (very) high marginal rate of say, 70% and that another special levy on those whose net worth/“unrealized capital gain” rose by say, over $1 billion/tens of millions, the additional revenue could run in the tens of $billions, annually, but without squeezing lower-income taxpayers – The mega rich would still only pay at the lower rates as everyone else on their incomes below that/those critical level(s), which may not be clear to many, if not most.

And, more than the rates what matters is on the amount over which a particular rate is set. Since 1981, in the “Reagan era,” the top rates have been too low, between 28% and 39.6% only, causing a steadily rising financial inequality, along with hunger and homelessness for far too many poor Americans: See “The Price of Inequality,” By Joseph Stiglitz, 2012. Watch Stiglitz on <booktv.org> for an exposé of this book.

In the 1986 tax-reform act, which was also touted by some liberal Democratic law makers, like Senator Bill Bradley (D-NJ), there were just two rates only, a top rate of 28% was on (any) taxable incomes above $29,750 ($65,100 in 2020 dollars), whether a household taxable income was $50,000 or $500 million you only paid at 28%, on over $29,750. And 15% on any taxable income below that. The total income tax revenue to the treasury did fall but not that much from when the top rate was over 90%, but the bulk of the income tax revenue fell on the broad middle class (lower, middle and upper middle classes) excusing the rich from shouldering their prior responsibility of paying the bulk of the income tax.

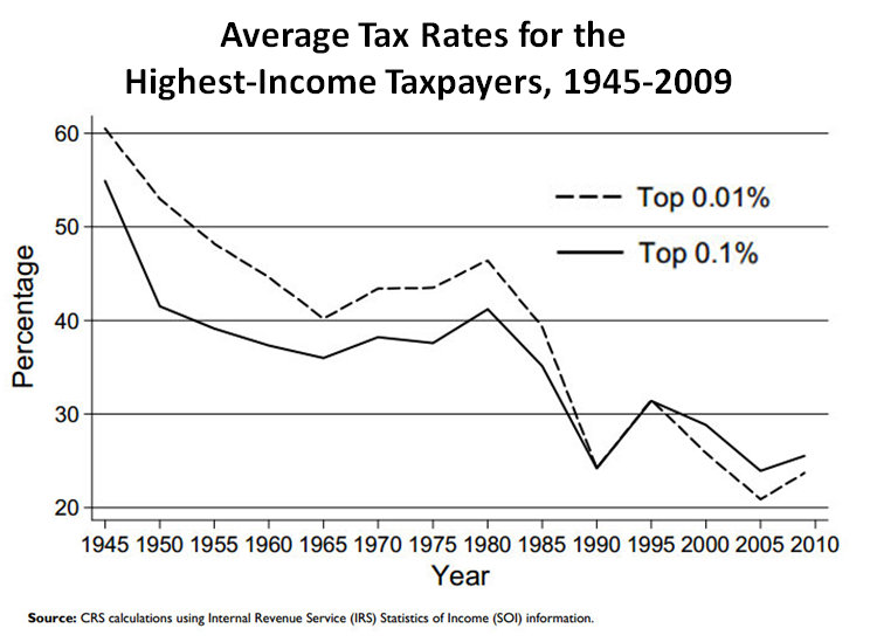

Figure 1. <https://upload.wikimedia.org/wikipedia/commons/e/e8/US_high-income_effective_tax_rates.png>

That unfair tax reform plan was slightly corrected by GHW Bush, who raised the top rate to 31% and Bill Clinton raised it further to 39.6%; the latter wasn’t bad. Income tax revenue rose appreciably with both tax hikes. But the welfare-reform Clinton (reluctantly) signed was too brutal on the poor. Clinton was able to balance the budget, which was unnecessary. GW Bush used the modest surplus to have tax cuts, which was huge when he cut the capital gain tax to 15% with having carried interest loophole.

The modest reduction in revenue from the Reagan tax cuts put a steadily rising pressure on social spending with an endless call to reduce “unnecessary” spending on safety-net programs – remember the welfare queen?

Certain stealthily inserted quirks make the entire system of taxation inscrutable, and confusing to most people, for some middle-class taxpayers to suggest a “flat tax,” as I had witnessed where I used to work, around the time Steve Forbes ran for president – flat tax is worst for the middle-class and best for high-income taxpayers: heard about the book, “What’s the Matter with Kansas (2004)?”

The Luck Factor

Warren Buffett famously said his wealth, as well as his happiness, has largely been from being born in this great country [in a decent, white, middle-class Nebraskan family] and the people he has been lucky enough to associate with. There are other rich folks like George Kaiser as well as scholars like Robert H. Frank who subscribe to this view, of luck, or lack thereof, determining our fortunes, not entirely but to a substantial extent.

Frank argues in his 2015 book, “Success and Luck: Good Fortune and the Myth of Meritocracy,” far too often, more than anything, luck plays a decisive role in our successes, including better-paying jobs and building wealth. And income and wealth, as our place and country of birth, gender, ethnicity, innate talents, etc., are largely a gift to us. Thus, the wealthy are to a great extent lucky, while the poor are mostly unlucky.

As Richard Cohen writes in Washington Post in 2018 about David Letterman’s interview of Barack Obama, “[Eventually, they talked about luck that played in their lives]. Yes, he had talent, [Obama] said, and he had worked hard, but neither of those could fully account for how a mixed-race kid who had known his father for only one month of his childhood had wound up president of the United States. He had been lucky.”

However, Money and wealth may not be the principal factor that determines our happiness. They are nevertheless critical, once one is devoid of discomfort from hunger and thirst and physical and mental pain, as money can acquire a good deal of happiness. Others are mental and physical health, association including with “best friends,” spouse, relatives, colleagues and neighbors, age, gender, race/ethnicity, intelligence, looks and instinctive judgments.

And moderate economic inequality is thus not that consequential. But abject poverty must be wiped out from the face of earth; abject poverty can be eliminated with minimal, additional ‘burden’ on the affluent, far less than what we or the affluent seem to believe.

The rich in Canada and the U.S. live very much alike but abject poverty is very low, if not absent in Canada – free, universal healthcare they receive may be a big part of it. In the U.S., a significant number live not too unlike the poor in the Third World.

A still more important is a nebulous factor, likability, which also may largely be inborn. (Likability and charisma may not be the same but are mutually dependent) An illustrative example for innate likability variation is the perceivably higher likability of President George W. Bush compared with his father, President George H.W. Bush as well as his brother Jeb Bush, who ran for president in 2016. Bush_41 (GHWB) was a very good president, often with surprisingly excellent judgments on issues that mattered in the long run, whereas Bush_43(GWB) as president was among the worst few, but he left his presidency almost unscathed, a “dividend” for his higher likability, I would argue. (Karl Rove was awestruck when he first met GW Bush. “[Rove] said he’d never seen so much charisma in one person in all his life,” which also reflects Rove’s high brainpower, to be labeled “Bush’s Brain”). Ronald Reagan and JFK are also great examples of innate, high likability whereas, Bill Clinton, Richard Nixon, Jimmy Carter, and Gerald Ford were hardly high in likability, though they must be better than average, to become presidents. (Robert Novak at his appearances on McLaughlin Group remarked that George HW Bush was a “lousy candidate,” but rationalized GW Bush’s ‘disengaged, uninterested style’ as just fine for a president! He also remarked, “You don’t impeach a President for lying about sex.”)

If I could further elaborate, Roger Rosenblatt wrote (Time Magazine, February 3, 1997, p. 78, before the president’s sex scandal became prominent), “[Clinton] is sweet and graceful … He works like a horse. He can weep on demand. He has spasms of inspiration. He blows up at the right people at the right times … Yet … he evokes less warmth than much stiffer predecessors.”

Whereas, an unusually charismatic Barack Obama was awarded the Nobel Peace Prize in 2009 before he did anything, which was denied to Jimmy Carter in 1978, when both Anwar Sadat and Menachem Begin received it; Zbigniew Brzezinski, Carter’s National Security Advisor, was profoundly disgusted when he learned Carter was “excluded” from the company of Sadat and Begin in 1978, as he described several years prior to his death – I too was quite disappointed when Carter was excluded, and I was profoundly disgusted in 1973 when Henry Kissinger was awarded it, despite his callousness, especially towards Bangladeshis in 1971; Kissinger had the power then to stop that genocide of about a million Bengalis/East Pakistanis by the W. Pakistani soldiers; he himself would have had a far worse life of a Nazi concentration camp and probable death had he not fled Germany at age 15!

As everything in behavioral science is complex and complicated, much like in economics, Obama’s impact on a white majority nation, with scattered racist segments embedded in it, ended up quite limited.

The Republican party, while proud of electing a black man as the president looked at his policy recommendations quite suspiciously, through a magnifying glass, to eagerly label them “socialist,” despite Obama perennially struggling to come across as “moderate.” They made a concerted effort to make sure Obama didn’t succeed especially in achieving universal healthcare. They calculated, that if Obama succeeded in anything tangible, that would lead to a substantially greater acceptance of the Democrats over them by the populace at large. And Mitch McConnell announced, “The single most important thing we want to achieve is for President Obama to be a one-term president.” Republicans have resumed their similar undermining efforts towards President Joe Biden as well, which they seemed to have applied first to Bill Clinton.

If I could further add, to me, Donald Trump though unscrupulous and thoroughly unfit to be president is high on likability and charisma. He wasn’t that bad as president either, but if he were reelected, he might have ended up as a terrible president, even worse than Bush_43, because of his grandiosity, irrationality, impulsivity, and poor touch with reality as well as making decisions almost exclusively for his personal, instant gratification, regardless of the consequences. He was so tone-deaf to complain that nobody gave him credit for the large crowd-size at the Capitol ground on January 06, 2021! – Jonathan Carl, Washington Week, PBS, October 15, 2021.

Despite his enormous gifts, on the other hand, Barack Obama abdicated his responsibility to fix Iraq and Syria. And despite his weaknesses, Trump bombed Syria twice, quite effectively so, but to his credit, he refused to bomb Iran, after Iran shot down a US Drone, while bravely killing Soleimani, rightly so, I believe. He deserves credit for killing Baghdadi a most callous and brutal tyrant, far, far worse than bin Laden – if bin Laden were living, I am tempted to argue (though few would agree with me and I could well be wrong as well), Baghdadi might not possibly have come to so much prominence. Trump also deserves credit, for such a rapid arrival of Covid-19 vaccines, while his “delusional,” or deliberate disregarding of Covid-19 pandemic, since he doesn’t care what happens to others, would likely cost around 200K more American lives.

Furthermore, Trump has been adored, revered by his followers, which he knew early on to say, “I could stand in the middle of Fifth Avenue and shoot somebody, and I wouldn’t lose any voters, OK?” However, Carlos Lozada of the Washington Post gives a good summary (September 2017) of experts’ assessment of Trump’s mental impediment.

(As a run-of-the-mill psychiatrist, I would venture to diagnose Trump as a unique case of chronic hypomania, without depressive swings. And he had been living in a fantasy world to provide comfort, and pleasure; he tends to fantasize aloud; his detractors see that and mock him constantly for him to react often by slipping back into his fantasy world. An example of him fantasizing aloud: After he returned from his meeting with Kim Jong Un, he casually [extremely so] said, paraphrasing, “Obama told me the N. Korea problem was the most difficult foreign policy challenge. I solved it,” without any emphasis on any part of that statement as if he was telling an aide, he finished peeing, showering or his diet coke!

And with a good deal of trepidation, I would suggest if he were to take say, lithium as a mood-stabilizing, “antimanic” medication at only a modest dose of 300mg-to-600 mg daily with a tiny dose of, say clozapine, or olanzapine, that could have reduced his agitation and impulsivity to function much less abnormally, but getting him to take any psychotropics would be about impossible – Indeed in those parts of the world where greater amounts of lithium was present in the drinking water, the suicide rate was significantly lower.)

Michael Cohen writes in his 2020 book, Disloyal, “… I confess I never really did understand why pleasing Trump meant so much to me and [to] others. To this day I don’t have the full answer. In a matter of a couple of months, I started falling under the spell of Donald Trump. The question no longer was what I would do for Trump—the question was what I wouldn’t do.” Katy Tur, the author of “Unbelievable,” 2018, another NY Times bestseller on Trump, said in an interview, referring to the answer of an admirer who said he was supporting Trump for his promise of building the “wall.” She then asked him what if he didn’t build the wall; his instant response was, “That’s okay, I trust his judgment!” Building or not building the wall had little relevance to most of his supporters/followers/disciples. Another example, on November 29, 2020, at the Fareed Zakaria’s GPS program, the famous author, Niall Ferguson, described Trump as “extraordinarily charismatic who changed the Republican Party.” Michael Wolff in his latest book (2021), “LANDSLIDE: The Final Days of the Trump White House” says, the people around Trump believed he had “magical properties,” based on “a genius sense of how to satisfy the audience.”

The Rationale for Progressive Taxation

In a civilized harmonious society, the “lucky” are expected to lend a helping hand to the unlucky. In wars, soldiers would go to extremes often risking their own lives not to leave wounded comrades behind. (Even in the animal kingdom, members of an elephant herd, usually led by a matriarch, make sure the weaker are not left behind.)

And progressive taxation is a fair way to mitigate the extreme distributional discordance of income and wealth, which has been worsening during most of the past several decades, since the beginning of the Reagan era, just about everywhere. By taxing the “luckier,” who make much more than the “less lucky,” without working that much harder (but harder, nonetheless), at moderately higher rates, modest but not equal redistribution of the benefits of incomes, could be provided to the less lucky. Unfortunately, there is a pervasive notion that paying higher taxes by the affluent is unjust.

Over the millennia, hundreds of millions of our fellow humans have perished before their time owing to insufficient purchasing power.

Nevertheless, with so much progress humanity has made so far, as Nicholas Kristof writes,“2017 was probably the very best year in the long history of humanity,” despite as bad as things have been with so much misery around. But it could have been far better with very little additional burden on the well-off, and long before 2017.

According to a (Henry) Kaiser Family Foundation study, “The large body of research on the effects of Medicaid expansion under the ACA (Affordable Care Act) suggests it has had largely positive impacts on coverage; access to care, [affordability], including impacts on state budgets, uncompensated care costs for hospitals and clinics, …” And if the ACA, a.k.a. ‘Obamacare’ were repealed, as repeatedly attempted by the Republican Congress as well as the Trump administration, it “would result in 217,000 additional deaths over the next decade.” (Those attempts already have had a negative impact. As Sarah Kliff writes in Vox, the percentage of uninsured has risen from 10.9% in November 2016 to 12.2% in December 2017, according to Gallup.)

On Tax-hikes on The Rich

Many superrich such as Warren Buffett, Bill Gates and George Kaiser are for raising taxes on the rich like them. Gates also advocates taxing investment income at the same rate as wage income; in 2014, he had proposed a ‘progressive tax on consumption, on buying yachts and private jets.

The 2003 drastic, capital gains-tax cut to 15% on up to $billion incomes (including investment and hedge-fund-managing commission incomes, applying the “carried interest” loophole) enormously widened the financial inequality by reducing taxes on top 0.01% incomes to 22% by 2005, which was near 60% at around 1945 (Fig.1).

In November 2017 over 400 millionaires and billionaires wrote to Congress asking not to cut their taxes, instead raise them; the patriotic millionaires have been doing so since 2010.

And former New York City Mayor Michael Bloomberg strongly attacked the 2017 tax law, calling it “an economically indefensible blunder that will harm our future.” He didn’t support raising taxes on the rich, however. He seems to be contented to continue pay his taxes at the current (low) rate; he rationalizes it by saying if the taxes are raised the rich, who can afford to move away would do so. This “Bloomberg attitude,” as against the attitudes of comparably conscientious Warren Buffett or Bill & Melinda French Gates, or George Kaiser or umpteen other immensely rich who Want to pay higher taxes, is a telling example of why we have so much inequality and misery in the world in that Michael Bloomberg disregards his indifference to paying so much less in taxes, proportionate to his income and wealth!

In a 2017 New York Times piece, Steven Rattner writes, “I have been a substantial beneficiary of the so-called ‘carried interest’ loophole, the tax provision that provides an indefensibly lower tax rate on profits earned by … hedge fund operators, real estate developers(presumably including President Trump)and the like.”

Furthermore, International Monetary Fund (IMF) finds that raising taxes on the rich to reduce inequality would not hurt growth. Even Steve Bannon, Donald Trump’s former ‘chief strategist’ actually wanted to raise taxes on the rich, unlike his other advisors, such as Larry Kudlow.

Unfortunately, with the 2017 “Tax Cuts and Jobs Act,” the Republican Congress cut the taxes of the rich when the financial (income and wealth) inequality has been so high and kept on rising. Oxfam (January 22, 2018) reports, “Richest 1% bagged 82% of [global] wealth created [in 2017while the] poorest half of humanity got nothing.” United States is no exception, as the richest three men have more wealth than the bottom half of all U.S. households, as described below.

Although moderate tax-cuts on corporate profits have been widely recommended, the 2017 cuts have been too drastic and would again mostly help the affluent. The carried interest loophole continued, though Donald Trump railed against it during the 2016 election season.

Taxes in the U.S. have been far less progressive since the beginning of the Reagan era, through Bush II 2003 capital gain tax-cuts, with some respite during the Clinton administration and since 2013. Andrew Ross Sorkin writes, “[The 2017 ‘Tax Cuts and Jobs Act’] benefit[s] the ‘ultra-rich’ … A real estate investor, Jason Harbor, who will probably be a beneficiary of the tax plan, wrote on Twitter: ‘Why are my taxes going down and my assistant’s is going up? Can someone explain how that is fair’?”

The Economist reports, “Americans appear to be less averse to inequality than citizens of other rich countries. … actual CEO-to-unskilled wage ratio in America is 354-to-1 [about ten times more than what Americans think]. … In 2014, taxes and transfers reduced American inequality by a mere 18%; this compares with25% in Britain, 29% in Germany and 34% in France.” If “taxes and transfers” were to rise as in, say France, with significantly higher progressive taxation as this piece advocates, the rising inequality could be sufficiently checked, even reversed some, which is what is needed.

But so long as the Republicans manage to prevail in strategic elections, whichever way they achieve, the “taxes and transfers” will favor the affluent at others’ expense. For example, in the 2016 election season, all seventeen Republican presidential candidates dutifully displayed their drastic tax-cut proposals, which obligatorily benefit the rich. (None of those seventeen probably had an accurate grasp as Bruce Bartlett or many of the candidates’ economic advisors had, which may even absolve them of the cruelty embedded in their proposals)

There appears to be a blind spot and/or ignorance in the Republican leader’s vision in that, more than anything, their identity is inextricably dependent on income tax cuts, almost entirely benefiting the affluent. Many of them cleverly couch the wording of tax cuts on the pretext that tax cuts for the rich, a.k.a. “job-creators” would help the nation’s economy in the long run, in turn benefitting all, the erstwhile ‘trickle-down-economics’.

Republicans tend to be smarter than Democrats. During the 2020 election season, the “Lincoln project” formed by former Republicans to oppose Donald Trump, put out some ads, which were uncannily effective. At the same time, Democrats without forethought started saying “Defund the Police,” which was bad enough but then that morphed into an almost lethal “Abolish the Police!” No Democratic leaders saw it as extremely damaging and tried to quell it. Joe Biden said, rather half-heartedly, paraphrasing, “I am not for defunding the police; they may need more help.” If he and some other Democrats high up had forcefully said, defunding the police was a terrible idea, the harm that may have caused would have died down. But that didn’t happen. It looks like only a small, radical segment of the Democrats bought into the idea of defunding the Police.

Our Poor Grasp of Taxation in general

All of us pay taxes. And are acutely aware of it too. We (grudgingly) accept it as a necessity, but if we could lessen it, whichever way possible without blatant cheating or breaking the law, like driving within six miles over the speed limit, we would gladly use that opportunity to lessen our tax burden. But we (wrongly) assume if (the progressive) federal income tax is raised it would be a greater burden on the middle class, as it is on the rich; the latter have been paying less and less federal taxes since 1981. If the (progressive) federal income tax is raised, the bottom 65%, if not 95%, would pay hardly more while they imperceptibly, perhaps, benefit in different ways such as with greater public spending to improve public services, and higher spending on safety-net programs. It would ordinarily affect the top 5-to-35% based on how the higher taxation is set on various income groups. Whereas, if local taxes, especially sales taxes, are raised, the lowest income groups would be hurt the most. The bottom fifth in income pays seven times more in sales taxes as a share of their income than the “top 1%” does. Sales taxes are quite regressive but easy to be raised specifically for one or another necessary local need usually by a quarter-cent at a time often with local ballot measures.

And as ProPublica uncovered, the richest [billionaires] pay minuscule amounts in federal income tax! Warren Buffett repeated in 2013, “he’s still paying at a lower tax rate than his secretary,” despite a higher tax bill in 2013 than in 2012. Many conservative pundits and their minions unabashedly repeated their mantra, “If Buffett thinks he’s not paying enough tax, why not him write a check to IRS and send it?

A telling example is what happened in 2010 in Washington state. “The plan devised by [Bill Gates Sr.] to slap a 5% tax on earnings over $200,000 — Initiative Measure 1098 — was rejected by 65% of voters,” despite that more than 90% of those who voted against it wouldn’t be paying any state income tax with that ballot measure if it had passed.

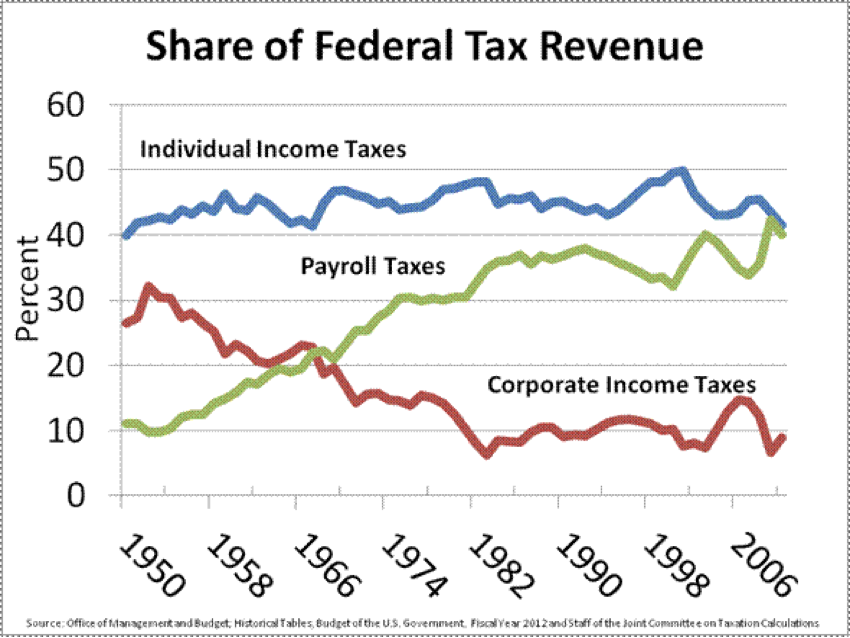

Most low-income households, around 45% of the total, pay no federal (individual) income tax, but they do pay, along with the middle class, disproportionately far more in federal payroll tax as a share of their incomes compared with the affluent, which was left untouched in the 2017 tax-law.

And in states like Missouri the rich disproportionately pay much less in state income tax than the middle class, 5.4% top rate on over $8,424. But many rich like those in California pay their fair share, up to 13.3%, on over $1 million income. Thus, one could reasonably infer,all income groups essentially pay at not too far from the same rate in their total taxes and the progressive income tax is largely, not entirely, a myth, especially since 1988. And there are nine states like Washington State without State Income Taxes.

Ideally, all states ought to have ballots in place similar to what California did in 2012 to raise revenue from higher income folks so that local taxes could be cut, even drastically, to help out poor folks.

True, low income-groups are helped by social safety-net programs such as SNAP (Food Stamps), earned income tax credit, Medicaid, disability benefits and temporary welfare, which are far too modest in the U.S. compared with other affluent countries making the life of the lowest income groups, including most minimum wage workers quite tough; many of them experience hunger and eviction as a constant threat adding to their misery.

Many of them, especially in inner-city areas, are subjected to constant threat of violence and senseless murders (Listen to an unusually touching interview of Jill Leovy on ‘NPR-Fresh Air’ on January 26, 2015 on her book, Ghettoside. This interview is so gripping, which will take you to a world you never imagined, with the unique inflection in the tone of Leovy’s voice, with profound empathy she, as a white woman displays with the mothers of black murder victims, who have been completely ignored by the society!)

True, those among the lower income groups who pay federal income taxes and some in the middle class would get some tax-cuts with the 2017 tax-cut law but comparatively far smaller than what the rich get as tax-cuts. The doubling of standard deduction in it benefits those who pay federal income tax but did not “itemize.”

However, the loss in revenue from all these tax-cuts would necessitate cuts in public and safety-net programs-spending, which is what the conservatives want and aim for. Former Speaker Paul Ryan, Former House Majority Leader Eric Cantor (R-VA), Sen. Rand Paul and company love to cut Medicaid, SNAP, Medicare, Social Security and unemployment benefits, or anything else that would benefit the inherently disadvantaged.

And only around the top 4% households probably would have tangible benefits from the 2017 tax-law. Even many among these top-income households, who think about the future, may end up losing out in the long run if they face layoffs, and other unforeseen calamities. Even if they escape such misfortunes, what about some or many of their current and future descendants?

Examples of Discordant Remunerations

Modest Discordance: The knowledge, skill/dexterity, and effort required for a cook at a McDonald’s and those of a United Autoworkers’ Union worker are fairly comparable, but the autoworker with pension and other benefits makes nearly four times more, as well as job security.

Thus, it is not an illogical argument that few are paid according to what they are actually worth. And progressive taxation is, therefore, a logical remedy. In the case of the McDonald’s cook, they may be paying no federal income tax and may get some earned income tax as a refund, while the autoworker pays at or close to the lowest level in federal income tax.

Extreme discordance: The top 25 hedge fund managers together raked in close to $100 billion, with a B, for the five years from 2009-to-2013, for their (socially) unimportant job, and then paying close to 15% (23.8%, from 2013) in federal income tax.

John Paulson’s haul for 2007 and 2010 together was $7.9 billion. And Steven A. Cohen of former SAC Capital raked in $2.3 billion in 2013; eight of his traders were either convicted or pleaded guilty for insider trading charges. Cohen himself had to pay $1.8 billion as a criminal and civil penalty that year, still pocketing a cool $500 million.

Whereas, Capt. Sully Sullenberger who probably saved the lives of all 155 onboard by skillfully landing the crippled USAir flight 1547 on the Hudson River on January 14, 2009, was paid in the neighborhood of $125,000, annually, which of course is significantly higher than the median wage, but pittance when the value of his job is factored in. – On December 28, 2014, pilot error was attributed to the loss of 162 lives when an identical plane lost control and fell into the South China Sea.

Alarmingly, Commuter Airline pilots have been paid in $mid-twenties. Many of them couldn’t afford to rent a comfortable motel room and might sleep in their cars, or bunk with others to save money. In the commuter plane crash of Colgan Air flight 3407 on February 12, 2009, on its way from Newark, NJ to Buffalo, NY that killed all 49 on board, a year-long investigation “found the probable cause to be the pilots’ inappropriate response to the ‘stall’ warnings.” But complaints about airline companies abound for baggage fees, etc.

After years of losing money and repeated bankruptcies, airline companies have been finally becoming profitable (until the coronavirus pandemic) but with such drastic and dangerous cost-cutting measures.

I thought the Airline companies, had signed (figuratively) a “suicide pact,” while the Drug companies have formed a most powerful “cartel,” to raise drug prices, making them far beyond the reach of most who need those drugs.

(Millions of AIDS victims perished in Sub-Saharan Africa, since the advent of the magic, three-drug-cocktail in 1996 [the discoverer, David Ho incidentally has largely been unappreciated, other than by TIME Magazine], as the cost per patient-year was over $10,000, which since 2005 or so has been procured for around $150. And millions of lives have been saved with Antiretroviral treatment, including in Sub-Saharan Africa where AIDS has been most prominent. – Watch Rep Katie Porter [D-CA] grilling a Big Pharma CEO.)

But these two contrasting business models are operating under the same free-market system. This inconsistency is an illustration of the built-in flaw that creeps up not infrequently into the free-market system.

Binyamin Appelbaum and Robert Gebeloff write, “According to an analysis by The New York Times [2012], Congress cut federal taxation at every income level over the last 30 years. [Don’t forget the bottom half in incomes pays hardly any federal income tax.] State and local taxes, meanwhile, increased for most Americans [Most Americans are not rich]. … Households earning more than $200,000 [the top 4%, most of whom could be seen as well-off] benefited from the largest percentage declines in total taxation as a share of income. … The average American in 2010 paid 30% more of income in payroll taxes than in 1980, even while paying 27% less in federal income taxes. As a result, revenue from the payroll tax almost equaled income tax revenue. [Meanwhile] income inequality rose to the highest level since the Great Depression.” (I would state, the above 2012 NY Times piece is the most relevant article that supports my arguments.)

Appelbaum appears to be quite enraged to bluntly state in a recent piece, “Resistance to taxation is the rotten core of the modern Republican Party.”

Historical Attempts to Reduce Incorrigible Inequality

Our innate altruism, which has been sharpened by religious, or idealistic belief systems, prompted us to strive for eliminating misery in people around us and minimizing inequality, but with limited overall success.

Jesus Christ, when viewed as human as well as Karl Marx [both happened to be Jews] strongly advocated socialism, but Marx, unlike Christ, specifically advocated violence [a fatal flaw of Marxism/Communism] to abate (atrocious) economic inequality but without any real “global” success.

(Pope Francis, to me, is by far the best representation of Jesus Christ among prominent men living, and Mahatma Gandhi among the recently dead, while Mother Teresa among women – Ayn Rand, whom Paul Ryan profoundly admires, could be seen as an extreme opposite, not because she was an atheist.)

Indeed, the twentieth century had witnessed enormous misery and millions of deaths from brutal violence and deliberate starvation, emanated in the process of implementing Marxism, in the Soviet Union, China, North Korea and Cambodia. This horrific misery unleashed on the masses may have been an inherent defect of Marxist theory (However, Marxist revolutions, as the French revolution, are an inevitable consequence of profound inequality.)

Nonetheless, there have been substantial successes at a small scale in certain parts of the world, but few readers would agree with me if I wrote the success of Marxism under Fidel Castro about 100 miles from the Florida coast. Despite American pressures, Cuba achieved phenomenal successes in providing a fairly good quality of life to all its citizens – free universal healthcare has been provided to have longer life expectancy as well as lower infant mortality than the USA!

But through democratic means, in the 20th century America with the “New Deal” and the “War on Poverty,” great strides in poverty alleviation have been made; (the former more for whites than for others, but the latter was about universal). The same has been achieved even more equitably in Scandinavia and much of (Western) Europe, also while preserving and through democratic means.

Indeed, Britain’s Tony Benn saw socialism as the “culmination of democratization.” Alternatively, I would say, ‘democracy is “incomplete” without socialism, and that socialism is incomplete without democracy’. Amartya Sen, a Nobel Laureate in Economics (1998) observed similarly that democracy can function as an antidote to famine and undue suffering of the poor.

After Stalin’s brutal suppression of opposition with far too numerous executions of his mostly imagined [in that if so and so got an opportunity, he would undermine Stalin’s authority, therefore, eliminate him before he could get that chance] and some real (such as Leon Trotsky) opponents, rather than enemies, Nikita Khrushchev first and finally, Mikhail Gorbachev with “perestroika and glasnost” tried to incorporate a good deal of democracy into soviet socialism. Unfortunately, that endeavor backfired crushing a sprouting democracy, as well as their seasoned socialism, owing partly to Boris Yeltsin’s incompetence and disengagement (Winston Churchill and Turkey’s Ataturk were heavy drunks, if not heavier still, but amazingly high achievers), but largely to Vladimir Putin’s ruthless oppression of his opponents.

Alternatively, if the Time magazine’s “Man of the Decade” Gorbachev had (magically) prevailed in the struggle between him and Yeltsin in 1991, the path of history, especially for the Middle East, would have been dramatically different.

Furthermore, I would claim, Jawaharlal Nehru tried his level best to implement both democracy and socialism simultaneously in such a vast, poor, illiterate, multicultural and multilingual India against such odds, even if its successes have so far been haphazard – Had Indian Supreme Court, as that of the U.S. did in implementing a fraction of what clearly stated in the Indian Constitution, all of India could have been free of so much financial misery! Bertrand Russell commended Nehru for his daring insistence of establishing democracy in India. Imran Khan (Prime Minister of Pakistan) has publicly acknowledged that Pakistan didn’t have a Nehru to strengthen democracy!

In 2003, while at war, Bush cut long-term capital gains-tax to just 15%. President Obama struggled to raise that rate to 23.8%, from 15%, which became effective in 2013. Both capital gain income and hedge-fund managing commissions, etc. are still taxed at 23.8%.

George H.W. Bush and Bill Clinton encountered substantial criticisms, for their moderate tax-hikes; Barack Obama also endured constant criticism and resistance from the Republicans. Obama, with the perennial support of Fed-chairman Ben Bernanke, a Republican, nevertheless managed to rescue the economy from the Great Recession. And the economy did not slip into another Great Depression, thanks to Ben Bernanke, former treasury secretary Hank Paulson, as well as George W. Bush (for accepting their advice), besides Obama.

The Republican party, under the leadership of Abraham Lincoln, fought the costliest civil war, wounding, literally and figuratively, most white families of America, essentially to end slavery! (I would even say the American Civil War [1961-1865] was the greatest sacrifice in history made by an all-powerful majority towards easing, relieving the suffering of a totally powerless minority, which was largely from conscientious, spiritual and/or Christian calling!)

But in the 20th (and 21st) centuries the (same) Republican party vehemently resisted, and continues to resist funding of Social Security, Medicare, Medicaid and lately Obamacare.

Nevertheless, President Eisenhower wrote in a private letter, “Should any party attempt to abolish social security [etc.], you would not hear of that party again in our political history. There is a tiny splinter group of course, that believes you can do these things … Their number is negligible and they are stupid.” But in this Reagan era, their number is neither negligible nor are they “stupid.”

Forgotten Magical, Persuasive Powers of Unique, Rare Leaders

Leaders with enormous charisma and eloquence can get the masses do unbelievable things (Donald Trump is perhaps the best example among the living, while Adolph Hitler is among the recent past, I think), an un/underappreciated reality, rather a forgotten fact. In a scientific paper I had written, “In a less dramatic way [compared with Joseph Goebbels admiring a 36-year-old Hitler], the American public was mesmerized by Ronald Reagan in the 1980s when they collectively perceived the immense contrast between him and Jimmy Carter. Reagan, like Franklin Roosevelt, offered simple solutions to complex problems, and articulated them forcefully, and both displayed a total absence of ambiguity. These two titans could steer the middle-of-the-road American public decidedly to the left in the 1930s and 50 years later, decidedly to the right”(Alias AG. Medical Hypotheses 2000;54(4):537-552; p 538).

Indeed, in recent years the famous historian Jon Meacham has stated about the same, on MSNBC Morning Joe and other programs!

It is conceivable that post-Reagan Republicans, and many Democrats as well, are under Ronald Reagan’s spell still, as the Garden-variety Republican, Dwight D. Eisenhower may have been under FDR’s spell. Or it may well be that when something is too popular, people would rather go along with it than challenge it.

Thus, the Reaganomics wins the day still. However, I think if there were greater majority in the Congress for Democrats, a couple of more seats in the Senate without losing any in the House in the 2020 election, the nation could have escaped from the grip of Reaganomics but may not be without difficulty.

The Guardian reports, citing Oxfam, by the end of 2016, just eight richest people in the world had as much wealth as the bottom half of the world’s total 7.5 billion people! Lower rates of tax collection from the rich probably are the major factor for this (dangerous) inequality. And by 2017, the richest three Americans, Bill Gates, Jeff Bezos and Warren Buffett, had even more wealth than the bottom half of all Americans.

However, Warren Buffett has pledged 99% of his wealth to go to charity. He has already donated about $33 billion to the Gates Foundation! Bill and Melinda French Gates have so far donated about $36 billion to their foundation; they have pledged about 90% of their wealth to go to charity (How their foundation, which has been the largest and most effective in history, would fare, with their divorce maybe uncertain.) Bezos, now being the richest man on earth, before Elon Musk axed him by the end October 2021, has not yet donated much to charity.

And just because many superrich in America over the past 100 years have been quite charitable, that can’t obviate the misery of the less fortunate. Through progressive taxation-law, the government ought to step in and ease the misery of the less fortunate, by taxing the affluent at a modestly higher rate, to spend on various safety-net programs such as greater EIC, Welfare, Social Security, Medicaid and the Obamacare.

As the charitable donations of the presidential candidates reveal, charities’ impetus varies widely:

| Candidate | Income ($ million) | Year | Charitable Donations (as %of income) |

| Mitt Romney | $13.69 | 2011 | 29.4% |

| Barack Obama | $0.79 | 2011 | 21.8% |

| Carly Fiorina | $1.95 | 2013 | 13.4% |

| Hillary Clinton | $27.90 | 2014 | 10.8% |

| Bernie Sanders | $0.21 | 2014 | 5% |

| Jeb Bush | $8.28 | 2014 | 3.7% |

| Ted Cruz | $2.00 | 2010 | 0.9% |

The still popular “supply-side” economic theory, pushed during the Reagan administration, though convincingly discredited recently with a real-life experiment in Kansas, had a lot to do with this rising inequality. Alan Reynolds of the Cato Institute wrote, “[The] topic of marginal tax rates became the central theme of a revolution in economic policy that swept the globe. … By the end of [1980s], more than fifty nations had significantly reduced their highest marginal tax rates. Neither Karl Marx nor John Maynard Keynes had so much influence [as Ronald Reagan had] on so many countries in so little time.”

But at this juncture, rather than tax-cuts, as the Republican majority did in 2017, tax increases on“top”incomes as well as wealth are what’s needed. (Or, if the top rate weren’t cut to 37%, and the passthrough provision were avoided, and the corporate tax-rate was cut to only about 28%, the 2017 tax law wouldn’t have been too bad.)

A big majority of Americans, including a sizable minority of the rich wants tax-hikes on the rich, as the inequality is too high, and most middle income and poor Americans struggle to make ends meet, with no signs of abatement.

The top marginal, federal individual income tax rate ought to go up to about 50% but only on, say the top 0.1% household incomes from all sources, or on over around $10 million. Long term capital gains, carried interest loophole, etc. should end at incomes over about $1 million, for taxation. (Some or far too many may not realize that up to the initial $10 million “taxable income,” these uber-rich would pay at the existing rates.)

The Danger of Going to Extremes, Including on Taxation

We all have an inherent tendency to go to extremes, in accumulating wealth, and stuff, which we may never even use like Imelda Marcos’s shoe collection, or expanding a despot’s empire as Genghis Khan did, or Napoleon & Hitler attempted but failed, by invading Russia. Or what Bush-Chaney did (with the advice of Henry Kissinger but against the advice of GHW Bush’s senior aides) by invading Iraq, which led to the creation of a most brutal ISIS/Daesh, all but destroying Syria (Barack Obama’s inaction made the matter far worse), not unlike the creation of even more brutal Marxist, Khmer Rouge regime in Cambodia, from the Vietnam war – Kissinger had a prominent, if not decisive role in both; what a callous, monstrous brute!

A seemingly innocuous and fully justifiable Black Lives Matter movement, mostly directed against (white) Cops, became a worldwide movement following the slow, heartless killing of George Floyd, who was already hand-cuffed, by pressing the white police officer’s knee against Floyd’s neck, while he was repeatedly crying, “I can’t breathe, I can’t breathe” and finally calling, “Mama,” perhaps before his last breath; it took a long nine minutes and 29 seconds, to “complete that murder!” When BLM gathered steam, it morphed into a cry for “Defund the Police,” then to “Abolish the Police.” The latter two backfired and may have caused significant, Congressional electoral losses for Democrats in 2020 (though, thank goodness, Joe Biden escaped), and in turn would likely weaken the BLM movement.

As for marginal tax rates, in the early years of World War II, the top marginal tax rate went up, all in 2020 dollars, from 81% on over about $88 million in 1941 to 88% on over (just) 3.17 million in 1942, then to 94% on over $2.94 million in 1944 (President Roosevelt indeed sought a 100% tax on over about $4 million – Bernie Sanders’s 2016 tax plan only called for a top marginal tax rate of 54% on over $10 million, not 90% on most of what we make – a CBS reporter visibly cringed by hearing the [erroneous] 90% figure, as seen on television).

Throughout the Eisenhower presidency, the top marginal tax-rate remained at a “confiscatory” 91%. And yet that was quite a prosperous period in American history, with rapidly expanding (white) middle class. President Eisenhower’s approval ratings were quite high as well, around 60% all through his eight years!

President John F. Kennedy sought to cut the marginal tax rates across the board, but the top rate was meant to come down only to 65%, from 91% to spur growth. That was opposed by conservatives of both parties in Congress. After the JFK assassination, President Lyndon B. Johnson managed to cut the top rate to 70% in 1964, not 65%. – Prominent Republicans continue to cite the JFK model as a justification to cut income taxes, evermore but factually erroneous.

Among the Republicans who voted against the 1964 “JFK tax-cut” bill, pushed by LBJ, was Sen. Barry Goldwater (R-AZ), a main leader of modern conservative movement.

Even the 70% rate was too high on over such a low amount of about $1.6 million in 1964, which was reduced by inflation to about $610,000 by 1980, both in 2020 dollars. Entrepreneurs must have resented in that much of what they made went as federal income tax.

Then in California, Howard Jarvis in 1978 managed to pass the “Proposition 13,” drastically cutting Real Estate taxes. That had a national impact. Even otherwise taxes in California was already quite high because Ronald Reagan as Governor paradoxically raised them to triple the state revenue in eight years!

During the 1980 election season, however, Reagan took advantage of a brewing resentment against high taxation. When he said he would cut taxes, raise the military budget and still balance the budget, based on the “supply-side” economic theory, George H.W. Bush (correctly) called it “Voodoo economics.” Reagan’s eloquence and charm muted such criticisms; he handily won the 1980 election, also because Bush was the Vice-Presidential candidate.

And the top rate came down from 70% in 1980 to a “dangerous” (though it had wide bipartisan support) low of 28% on over about $61,000, in 2020 dollars. All (taxable) incomes over $61,000, whether they were $100 thousand, $100 million or $1 billion or higher, were taxed at just 28%, a humungous windfall for the rich. All taxable incomes below that were taxed at a substantial 15% rate, squeezing the middle-income groups; the total federal income tax revenue fell but not that much.

The problem with such a low top rate is that the bulk of the tax-revenue would come from middle-income taxpayers, a recipe for widening inequality.

Then George H.W. Bush raised the top marginal rate to 31% in 1990. Bill Clinton raised the top rate substantially to 39.6% in 1993. Still, economic inequality kept widening, albeit more slowly.

Most of us do not quite understand how our income tax-system is structured and works for us. As said above, Bruce Bartlett writes, “[Congress] had no idea how many tax loopholes there were or how much revenue they were costing the Treasury.” If such loopholes, or “tax-expenditures” were completely eliminated the tax-revenue can go up by about a third. But almost all loopholes have legitimate, justifiable defenders.

We tend to believe if (the federal individual income) taxes were cut we all would pay less, which hardly applies to most. Only the rich would benefit from progressive (income) tax-cuts. The 2017 tax-cut law is no exception, though the “non-rich” also get some crumbs, from this tax-cut law, which are more illusory.

Most of us could be hurt from (income) tax-cuts, in general owing to the loss of revenue, and consequent, eventual cuts in public spending. On the other hand, (federal income) tax-hikes usually mean adding one or more brackets at the top, as in 1990, 1993 and 2013, which would benefit lower-income groups much more, even if some in the upper middle class end up paying ‘a few more dollars’. However, this is not immediately apparent to get enough public support. The higher revenue to the treasury comes mostly, if not entirely from the high-income-groups. We all, including many among the affluent would benefit from higher public spending, etc. When there is more money to spend without borrowing more, the debt-to-GDP ratio would remain tolerable at least, if not falls, eventually from higher growth. And the general confidence in the economy would improve. The (Higher tax on high incomes hardly hurts the economy; it’s just propaganda conveniently put out by the affluent.)

However, I think economic growth for the sake of raising GDP numbers is counterproductive. For example, the U.S. especially rely so much on the “toxic” auto-culture, more, not always or necessarily, by deliberate avoidance of public transit system. When individuals buy heavy, low mileage SUVs, as against high mileage lighter and cheaper cars, it further accelerates global warming, but would register an “equivalently” higher GDP growth. (The SUV craze is a cultural/fashion trend, very much like the cyclical widening and narrowing of neck ties as well as other trends in fashion; even electric vehicles for fighting global warming are focusing more on SUVs! SUVs are a menace on the road killing and injuring people in lighter sedans in substantially greater numbers) – Decades ago, Gore Vidal with his characteristic hyper-confident demeanor, declared, “Our GDP ought to come down.”

Wealth tax

Senator Elizabeth Warren proposed a wealth tax of 2% on wealth over $50 million, and 3% on wealth over $1 billion, annually. I think that is a little too high, which may not last from probable, concerted opposition; I hope I am wrong.

An inescapable fact is that the wealthy are as a group not only just luckier than the poor and the less well off, but are also generally smarter. And smart people would find ways to raise their incomes and to accumulate wealth. On the way, they tend to exploit the deficiencies in luck and smartness of the less well-off.

And I would suggest tax the wealth more modestly, so that a significant minority of the wealthy would see that such a taxation is only fair, even necessary. Since it is not that difficult to calculate the approximate value of wealth for the prior year, and assess their tax, as Real Estate and Property Taxes are assessed for most, at a given formula.

A 1% annual tax on the wealth of top 0.1% wealth, which ought to go up to 2% on the top 0.01%. (This could well be an approximate model for other countries as well.) The inheritance tax could be gradually phased out with this annual wealth tax, which is less burdensome to the wealthy than levying their descendants when they inherit the wealth. Besides, the eventual elimination of inheritance tax, the so-called “death-tax,” could be a selling point; the revenue from inheritance tax has also been shrinking.

Drastic Top Marginal Rate-Reduction Could Lead to Rise in Financial Crimes

When the top marginal rate came down from 70% in 1980 to 28% in the tax reform of 1986, for many it was too tempting to bend the rules to make more, as they could keep 42% more of what they made. But an alternative argument for lowering rates, without losing revenue, is that high income-folks would pay up, rather than trying not to pay what they legally owe. True, but only up to a point. The temptation to bend the rules would still be too powerful, more so at potentially very high-income level. Eventually, the bending of rules did morph into breaking laws. Michael Milken, a creative genius in finance for example broke laws. He raked in $550 million in 1987. Subsequently, he received ten years in prison but served only two.

In the mid-2000s, with the Bush tax-cuts, though the top rate was still 35%, by the drastic cuts in long-term capital gains, and with the carried interest loophole, taxes on the highest incomes dropped to a low of 22% by 2005, which was near 60% around 1945 (Fig. 1). White-collar crimes shot up again. US attorney Preet Bharara secured 85 straight convictions since 2009 by the middle of 2014, on insider trading cases!

One could compare the very low tax-rates on very high incomes, tempting tycoons to break laws, to too liberal prescriptions of oxycodone of late by unscrupulous drug-companies and too compliant physicians and the resultant very high death rates from opiate overdoses, which recently crossed 100K in the prior 12 months!

Burden of Payroll and Local Taxes on the Working Poor

Federal payroll tax is brutal on the working poor. Many of them may not realize its gravity, as they think it’s like paying sales taxes. Payroll tax burden proportionately diminishes as the income goes up to reach negligible levels in the, say top 0.2% or so income households, as there is a cap ($137,700, for 2020, $142,800 for 2021) on it beyond which payroll tax isn’t levied. Thus, payroll tax is unconscionably regressive.(Medicare tax is levied on all incomes.)

And low-income households are greatly burdened by them. Too many of them regularly pay exorbitant interests to payday lenders to stay afloat. (As the paradise papers show some of the richest people “legally” participate in this racket of payday-lending to further fatten their net worth.)

Therefore, (federal) payroll tax should be cut to get a modest relief for the working poor and the lower middle class. The payroll tax on about the first $10,000 should be cut to 1%, and the second $10,000 to 2%. If the employers also get a relief on their share of payroll tax, they can pay a higher wage to their low wage employees. To make up for the shortfall, the cap on it needs to go up. Preferably, the cap should be lifted, but then to make it less unpalatable to the rich, the payroll tax should again be cut to 1-2% beyond say, around $250,000. This would extend social security solvency as well. Many youngsters of today feel social security may not be there for them when they are eligible to collect it.

Thus, moderate tax-hikes on the top 0.1% incomes to, say about 50% is substantially beneficial to our society and it could also be a model for other countries to emulate. There could also be two more higher rates of 40% and 45% in between 37% and 50%.

I would further recommend another top tax-bracket of 60% and/or 70% on incomes over say, as high as $50 and/or $100 million – as said earlier, such rates were mostly under around $1 million between 1965 and 1981. This high rate may affect mostly or most of the “top 400” household-incomes. But it would bring in tens of $billions in revenue annually. And it could also function as a brake on rising economic inequality.

Robert Reich proposed a 70% top tax-rate on over $15 million incomes in 2011. Unfortunately, few Democrats supported that “modest proposal.” Conservatives mocked Prof. Reich, which on the surface looked justifiable more so because the Democrats were then too quiet.

As others have suggested, minuscule taxation on Wall Street transactions, to go up gradually to reach the European level is quite desirable, to benefit investors as opposed to back-and-forth traders in lightning speed. Jesse Eisinger of ProPublica had an excellent article in the now defunct Portfolio.com in 2008. His more recent New York Times piece argues for a 0.03% Financial Transaction Fee, as in Europe.

Gradually rising gasoline and diesel tax, a justifiable flat tax, to reach the European level in eight-to-ten years is also necessary, for the sake of our planet and for infrastructure repair and development.

(As an Indian American, it is painful to see the persistent poverty in India, especially in the rural Northern India. [On CBS 60-Minutes program of December 19, 2021, one segment was on the terrible sewage disposal issue in rural Alabama!] Some ten million bonded laborers live and work in virtual slavery in India still! Tens of millions of untouchables remain untouchable in India. Compared with casteism in many parts of India, the racism in the USA is and has been much less malignant, I believe. A good proportion of Dalits [Untouchables] in India do not look much different from many Indian Brahmins.

India has some 140 $billionaires, worth over $800 billion, which they accumulated mostly by exploiting poorer Indians.

If India’s rich were taxed, and collected at a fair rate, satisfactory sanitation and safe drinking water, and basic housing could be made available to all Indians. That was already achieved in the Southern Indian State of Kerala by 1990, which indeed was largely, not entirely an achievement of the Communist party there, ruling Kerala of about 35 million, alternately since 1957 – Communist party attained power through ballots for the first time in the world in 1957 in Kerala, forty years after Lenin seized power in Russia. [Communists ruled much larger W. Bengal with a population of 90 million, straight, not alternately, from 1977 to 2011, but without the progress Kerala achieved – “Free-market-like competition,” unlike in W. Bengal, helped Kerala?] This progress has later been extended to the neighboring Tamil Nadu with 67 million, without the influence of communists, and largely by copying the ‘Kerala model’; I wish all of India copied the ‘Kerala model’. [One report showed infant mortality in Kerala is at par with that of the U.S. with less than 10% of PPP!] “Kerala has a Human Development Index of 0.78 (Norway: 0.96, highest; U.SA: 0.93; Saudi Arabia: 0.85; Cuba: 0.78; China: 0.76; India: 0.65), which is ‘high’ and the highest in India. Kerala also has the highest literacy rates among all Indian states at 96.2% and a life expectancy of 77 years which is among the highest in the country”- Wikipedia. The saddest aspect of poverty in India and other poor countries is that the well-off consider the poor ‘not fully’ human. Only the problems of the well-off are considered genuine national problems!)